An assumable home loan is actually a variety of property financing arrangement where an outstanding house loan and its phrases are transferred from The present owner to the customer.

How much To place down. While 20 p.c is regarded as the conventional deposit, it's actually not needed. Quite a few borrowers put down as little as three per cent.

Smaller sized loan size: The more you place down, the less you’ll really need to borrow along with your primary home finance loan. Shaving 10% from the loan sizing allows some potential buyers to remain within conforming loan restrictions, which can eradicate the necessity to get a costlier jumbo mortgage loan

A house equity loan could be a better choice financially than the usual HELOC for people who know specifically how much fairness they should pull out and want the safety of a fixed fascination fee.

Lots of people elect to refinance their FHA loans as soon as their LTV ratio reaches 80% to be able to do away with the MIP need.

No matter whether you end up financing both loans with two separate mortgage loan lenders or the exact same a person, you’ll submit your next home loan application while securing your 1st house loan. For those who’re working with just one lender, the loan method will likely be relatively streamlined considering that they have already got the necessary information and facts.

Also, bear in mind your own home is now collateral for the loan as an alternative to your automobile. Defaulting could bring about its loss, and shedding your property can be substantially far more catastrophic than surrendering a car or truck.

YOU CAN BRIDGE A PENDING Dwelling SALE Funds Hole. An 80-10-ten loan can assist you quickly protect the deposit on a completely new household should you’re continue to seeking to sell your recent dwelling. Even better: You should utilize the earnings from a household sale to pay back the 2nd property finance loan with no refinancing.

In cases like this, you might have a jumbo loan and become matter to bigger interest fees, however it may match out for being less costly and even more practical In the long term.

Though it could be easier to qualify for a more compact loan amount of money with lousy credit rating, you can qualify more info for an $80,000 personal loan with negative credit history. As we talked about within the area earlier mentioned you can find items bad credit score borrowers can perform to raise the likelihood of acceptance. When you have credit rating difficulties or less than ideal credit score you may want to think about implementing which has a co-applicant. Furthermore, we very recommend you employ a web-based lender. As compared to banks and credit unions, on the net lenders normally have much more lenient qualification benchmarks.

Bankrate’s editorial workforce writes on behalf of YOU — the reader. Our aim should be to provide you with the ideal information to assist you make wise personalized finance decisions. We follow stringent recommendations to make sure that our editorial articles just isn't affected by advertisers.

Homebuyers at times use piggyback dwelling loans like a workaround into a twenty% deposit. Typically, borrowers must fork out for private home finance loan insurance plan (PMI) should they put down lower than twenty% on a house order.

Lifetime insurance doesn’t need to be complex. Come across satisfaction and select the suitable coverage in your case.

Tougher to qualify. A piggyback loan involves you to possess a lower financial debt load in comparison to your income and good credit, rendering it harder for getting authorised.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Erika Eleniak Then & Now!

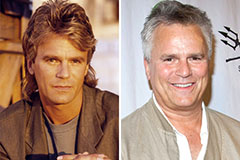

Erika Eleniak Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!